Such, should your costs is actually $4,one hundred thousand per month along with your net gain is actually $14,100000, you’ll features $10,100000 a month open to place for the maintenance a home loan. When figuring payments on your own mortgage loans, your own bank will normally include around 2.5% for the interest. The lender have their own unique Borrowing Power Calculator formula to own calculating the borrowing from the bank electricity (also referred to as borrowing skill) and that is regarded by the Loan providers as your home loan serviceability. Really mortgage brokers are provided more 3 decades (360 days), and therefore increases borrowing energy. If you are lengthened terms can be found, it trigger spending far more total focus over the existence of your own mortgage.

Because of the information your own borrowing from the bank electricity, you can make told behavior when planning your household get. We will be here to support you regarding the processes, assisting you navigate the reasons and powering your to your greatest home loan options. When you’re in a position, we invite one to Demand A totally free Lending Means Lesson. Carlisle Property’ Borrowing Power Calculator is made to help you know your own credit capability, empowering one take the next step for the your perfect household. Supported by money professionals, that it device makes it simple in order to estimate simply how much you could potentially acquire for home financing according to the money you owe, letting you be sure about your upcoming household preparations.

^Assessment price caution | Borrowing Power Calculator

The results produced by which calculator derive from the newest inputs you provide as well as the presumptions place from the you. Such efficiency shouldn’t be thought to be monetary advice otherwise a good recommendation to purchase otherwise sell people monetary device. Using this calculator, your accept and agree to the newest conditions put down inside disclaimer.

We acknowledge the standard Owners of the countless lands where i live and you can performs and shell out the areas in order to Elders previous, expose and you can emerging. I enjoy the new stories, community and way of life away from Aboriginal and you may Torres Strait Islander Elders from all the teams regarding the of several lands where we live, performs and you may collect. Sometimes 9 out of ten lenders will say no, but you might match perfectly into the one which your most likely never ever would have receive by yourself.

Utilizing The Home loan Qualifications Calculator

Within our calculator, sensible correlates to a great twenty eight% DTI, stretch in order to thirty-six% and you may competitive to help you an excellent 43% DTI. An income tax analyzed on the a house by the local government, usually in accordance with the value of the home (for instance the house) you possess.

Communicate with an expert now by the scheduling a demand and have a demo on exactly how to determine borrowing from the bank strength for your exact state. If you do so it yourself, it can help you get a simple start to see in case your wants is logically aimed to the loan providers borrowing from the bank skill assistance. A great designation provided by the fresh CDFI Finance in order to formal communities one render economic characteristics within the reduced-money groups also to people that lack use of funding. Qantas Points will never be given if your financing is within arrears otherwise default, otherwise any of the consumers get monetaray hardship rescue or advice at the time of crediting the brand new issues. The new Qantas Constant Flyer member selected to get Qantas Points do not are entitled to Qantas Issues to the a good CommBank Digi Mortgage give previously. A part have several CommBank Digi Home loans, in addition to joint applications, nonetheless they is only going to be eligible for Qantas Things after.

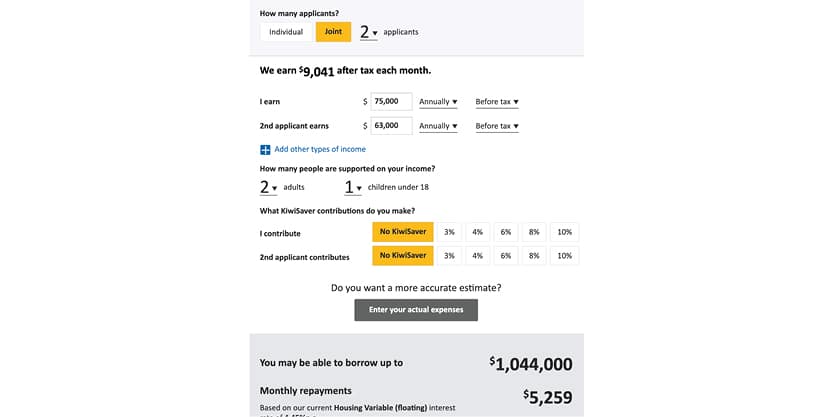

Our very own borrowing from the bank calculator was designed to estimate how much you may also have the ability to use based on your earnings, costs, and you can financial obligations. It will not cause for your own deposit since your deposit impacts the entire possessions rates you really can afford, instead of the number you are able to use out of the financial institution. Programs is actually subject to credit recognition, satisfactory protection and you may minimal put standards. Full fine print will be lay out within mortgage render, in the event the an offer is created.

Lenders imagine HECS repayments as part of your full bills, which can reduce your credit capability. The newest feeling depends on the dimensions of the HECS debt and you can their cost package, since these items influence the throwaway income and you will power to manage a lot more mortgage costs. It is important to cause of HECS financial obligation whenever evaluating the borrowing ability to make sure you can be comfortably perform all your monetary requirements. Borrowing from the bank strength will depend on evaluating in case your latest monetary points will allow you to solution your home loan across the specified loan months. Utilizing the money.com.bien au borrowing power calculator, you get into your revenue and you may costs so you can imagine just how much you can acquire to possess home financing.

The newest cost of living you may need to pay is at the mercy of change over the years, and there is no chance to assume just what monetary obligations could possibly get emerge because day. Understanding that it, you should understand one with extreme borrowing from the bank strength today will not make sure it can continue to be in that way over the longevity of the brand new financing. Numerous points could affect your borrowing strength beyond earnings and you may costs. Believe a good bank card or unsecured loan expenses, borrowing from the bank constraints, borrowing account, and credit history. The specialist mortgage professionals provide intricate knowledge to the elements you to influence their credit skill.

Weekly / fortnightly quantity just pertain if you’re also spending by Direct Debit (set up having CommBank). For everyone almost every other commission steps, you’ll need to pay the monthly amount. Get conditional pre-approval in order to with confidence come across your home. Talk with our loan providers or initiate your application on the internet inside the ten minutes. Interest cost are influenced by the brand new economic places and can changes daily – or multiple times inside the exact same date.

- The fresh imagine doesn’t be the cause of the loan qualifications criteria, nor consider carefully your complete budget.

- DTI is the quantity of continual month-to-month financial obligation you’ve got compared to the monthly revenues.

- It’s fundamentally an estimate of the limit matter you can afford in order to borrow when you’re nevertheless to be able to comfortably satisfy your loan repayments.

- Very home loans are given more than 3 decades (360 days), and therefore maximizes borrowing from the bank strength.

- The newest cost of living you may have to shell out try subject to change-over many years, and there is no chance to predict exactly what monetary responsibilities get emerge in that go out.

Through the an appeal simply several months, their desire only payments will not decrease your loan equilibrium. Besides your revenue, your own financial may also think about your expenses just like your lease, bills, school fees and child care can cost you for those who have kids. Lowering their costs doesn’t only save a little money to have a deposit but increases your own borrowing strength. Playing cards (also unused restrictions), signature loans, HECS/Help loans, or other obligations can aid in reducing your own credit ability. The fresh calculator brings a standard estimate of one’s borrowing limit. It doesn’t take into account all aspects of the finances, nor does it create an excellent pre-approval otherwise official lending analysis.