The fresh airdrop, cherished at the time around $step 1,eight hundred, is provided for more than 250,100000 Ethereum addresses. Uniswap program in addition to employs Liquidity swimming pools to possess buying and selling additional pairs from digital possessions. Other decentralized transfers have started subsequently, however, Uniswap is becoming by far the most well-recognized from the an extensive margin. Without central control, full openness, and a person-friendly program, Uniswap allows profiles so you can change easily.

Uniswap v3 | Shelter out of Possessions

That is basically for the level on the larger central exchanges and you may allows pages to save cash to your deals. However, with regards to the network used, the fresh network fees may be higher due to community hobby. Ethereum is infamous to own higher gasoline charges through the large market volatility. As the Uniswap is actually a decentralized replace constructed on Ethereum, there are also community charge (known as “gasoline fees”) so you can processes for every deal. Such charge is going to be outrageously highest, particularly while in the times of high community obstruction.

How to put liquidity on the Uniswap

As opposed to conventional transfers, decentralized transfers will not need to follow know-your-customers laws. Uniswap V2 uniswap v3 implements the newest features enabling very decentralized and you will control-unwilling to your-chain rate feeds. This can be achieved by computing prices when they’re costly to manipulate, and you will smartly accumulating historic study.

A winnings to own DeFi ‒ SEC Closes Research on the Uniswap Laboratories

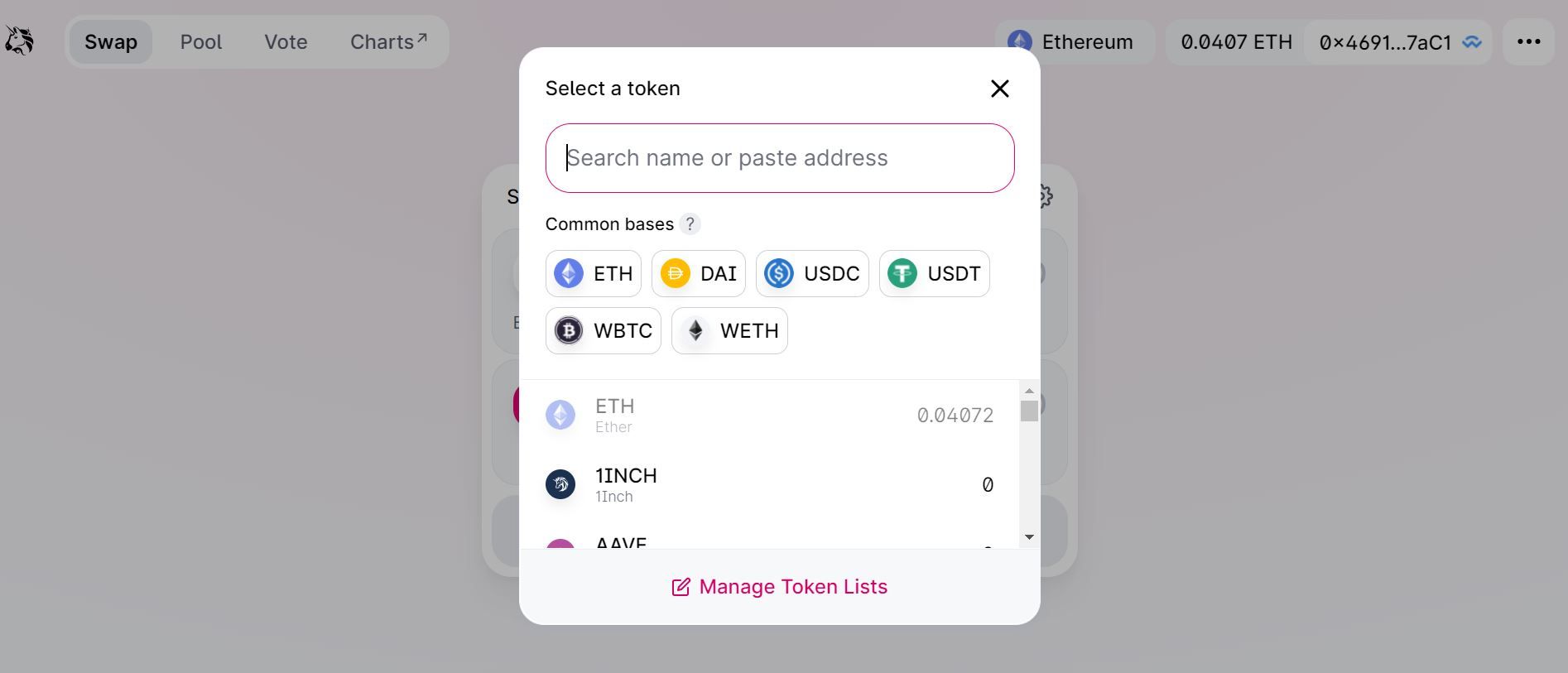

Once you have chose the brand new tokens we should exchange, you can go into the amount we would like to trade. You can get otherwise sell you to token for another considering the modern exchange rate. Simultaneously, you will see a network fee, which is the fuel charge a fee can get to expend so you can perform some change. Decentralized Finance (DeFi) produces economic devices offered to somebody.

Crypto Payroll: The ongoing future of Salary Repayments

- And nonfungible tokens, Uniswap has disclosed concentrated liquidity positions.

- According to the newest rates, Uniswap is the new last-premier decentralized financing (DeFi) program and contains more than $step three billion value of crypto possessions secured out on the their protocol.

- You can click on the notice to access your order to your the fresh blockchain explorer.

- When the market rates flow additional an enthusiastic LP’s specified budget, the exchangeability is actually effectively removed from the new pond which is zero prolonged earning charges.

Uniswap usually instantly regulate how far you are going to discovered to your other token. You’ll have to establish the connection for many who’lso are connecting via a third internet browser expansion and/or cellular app. Other a good alternatives would be the Trust bag and you can Coinbase purse. From the Traditional Period of crypto (2014), Vitalik described decentralized autonomous organizations (DAOs) as the “automation at the center, individuals in the corners.” If tall really worth settles based on the rates because of so it mechanism, then cash from a strike almost certainly is also surpass the loss. Really profiles swap for the Uniswap as one of the very first steps onchain.

Uniswap is additionally completely open origin, and therefore anybody can duplicate the fresh password to produce their decentralized exchanges. Typical central transfers is actually money-inspired and you can fees high costs in order to list the newest gold coins, which means this by yourself try a distinguished distinction. By the sustaining control over individual tips, they does away with risk of shedding possessions in case your change is actually ever hacked.

- Uniswap allows profiles to produce the swimming pools, generally a good combining from electronic property, including USDC/ETH.

- Swapping to the Uniswap is very thinking-custodial, which means you always hold control over their assets — with no 3rd party usually takes or misuse your fund.

- It varying can be utilized from the additional deals to track precise time-adjusted mediocre rates (TWAPs) round the at any time period.

- The standard central exchanges try profit-inspired and you can fees listing costs, very DEX’es is actually preferred over most other transfers to possess token listings.

- If this is your wallet’s first time trading that it token which have the new Uniswap Process, you ought to accept the new token earliest.

In pursuit of a far more open and you will reasonable economic climate, the fresh Uniswap Basis helps the development, decentralization, and you will sustainability of one’s Uniswap community. Nevertheless the kind of tax your’ll shell out to your staking relies on your location and just how the fresh DeFi method you’re using work. They retreat’t provided clear tax tips for DeFi platforms such as Uniswap. Immediately after accomplished, you’ll discover a verification and can song the new reputation on the Etherscan. The liquidity reputation usually then be live and you can in check in the V3 Pond page.

Buyers can also be exchange Ethereum tokens without being worried about the safety of the funds on Uniswap. In the meantime, anybody can give the crypto to help you liquidity swimming pools, which happen to be unique reserves. Which tool allows cryptocurrency trades rather than discussing middlemen otherwise 3rd people.